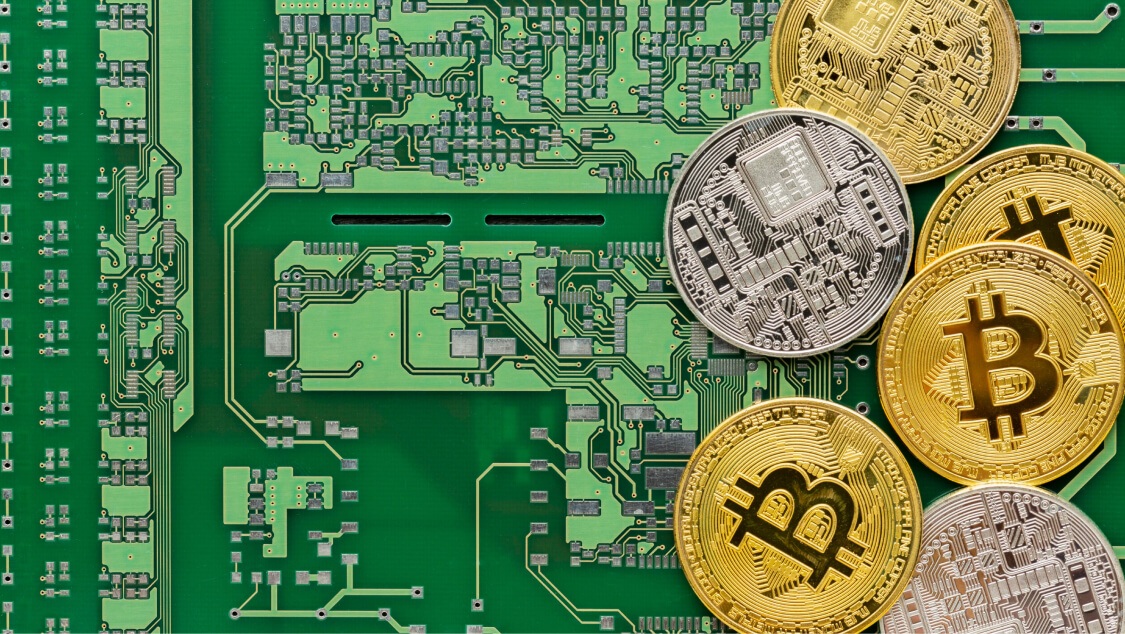

Cryptocurrencies have played a huge role in finance, but they’ve sparked some serious concerns about energy consumption. Bitcoin, for example, uses an estimated 127 terawatt-hours per year—more than the annual energy usage of some entire countries.

In fact, the carbon footprint of Bitcoin mining rivals that of some major industries, emitting roughly 65 megatons of CO2 per year. As the demand for digital currencies grows, so does the environmental impact, raising the question: can crypto go green?

With this in mind, eco-friendly, or green cryptocurrency, is emerging. As the crypto world becomes more eco-conscious, green cryptocurrencies are gaining traction, appealing to investors who care about sustainability.

In this blog, we’ll see what makes these cryptocurrencies green and explore how they’re shaping a more sustainable future for blockchain technology.

What is Green Cryptocurrency?

Green cryptocurrencies are digital currencies developed to minimise environmental impact, focusing on sustainability and energy efficiency.

Unlike traditional cryptocurrencies that rely on energy-intensive methods, green cryptocurrencies use innovative approaches to reduce carbon footprints. They are like the eco-conscious version of Bitcoin and Ethereum.

Here’s why they matter:

- Reduced Energy Consumption: Traditional cryptocurrencies like Bitcoin use the Proof of Work (PoW) consensus model, which demands massive amounts of computational power. Green cryptocurrencies, on the other hand, often use alternative consensus mechanisms like Proof of Stake (PoS), which consume far less energy.

- Lower Carbon Footprint: Eco-friendly cryptocurrencies are designed to leave a smaller carbon footprint, which makes them attractive for investors who care about the environment and sustainable growth.

- Aligning with ESG Goals: Many companies and investors now prioritize Environmental, Social, and Governance (ESG) factors. Green cryptocurrencies fit into this trend, as they align well with global sustainability goals.

How Are They Different from Traditional Cryptocurrencies?

Unlike the massive energy demands of PoW used by Bitcoin, green cryptocurrencies rely on alternative models that drastically cut down on power needs. Here are some key differences:

Proof of Stake (PoS) vs. Proof of Work (PoW):

- Proof of Work: Requires miners to compete by solving complex mathematical problems, which takes an enormous amount of energy. Picture rows of computers churning away in a warehouse, all drawing huge amounts of electricity.

- Proof of Stake: In contrast, PoS chooses validators based on the number of coins they hold and are willing to “stake” as collateral. This method uses a fraction of the energy that PoW requires, making it much more efficient.

Carbon Offset Programs

Some green cryptocurrencies even partner with environmental organizations to offset their carbon footprint, going beyond just energy efficiency.

Notable Green Cryptocurrencies

Let’s look at a few of the leading players in this eco-friendly space:

Solana (SOL):

- Uses a hybrid Proof-of-History (PoH) and Proof-of-Stake (PoS) system, which is energy-efficient.

- Low energy use per transaction with high-speed, low-cost transactions.

- Focuses on environmental sustainability in blockchain technology.

Want to learn more? Discover how Solana’s eco-friendly approach can power your next project!

Cardano (ADA):

- Uses Proof of Stake, which allows it to be one of the most energy-efficient cryptocurrencies.

- Focuses on scalability and sustainability, supporting projects around the world that aim to address societal issues.

- Recently launched an initiative to fund tree-planting efforts, further reducing its carbon footprint.

Algorand (ALGO):

- Algorand has committed to being carbon-negative by using a highly energy-efficient consensus mechanism.

- The platform is designed to balance speed, security, and environmental impact, making it a solid choice for those wanting green investments.

- They’ve partnered with ClimateTrade, an organization that helps offset carbon emissions for blockchain projects.

Tezos (XTZ):

- Another eco-conscious choice that relies on Proof of Stake.

- Unlike many other blockchains, Tezos is built to improve over time through self-amendment, allowing it to adjust and adapt without needing energy-draining hard forks.

- They emphasize environmental responsibility and have partnered with organizations to make their blockchain as green as possible.

Hedera Hashgraph (HBAR):

- Uses a unique consensus algorithm that is carbon-neutral.

- Aims for carbon negativity with very low energy usage per transaction.

- Efficient and environmentally sustainable.

Chia (XCH):

- Uses “Proof of Space and Time” to leverage unused storage space instead of intensive computing.

- A low-energy alternative to traditional mining.

Stellar (XLM):

- Uses the Stellar Consensus Protocol, reducing energy consumption.

- Focuses on eco-friendly practices while supporting financial inclusivity.

Nano (NANO):

- Uses a block-lattice architecture that doesn’t require mining.

- Fee-less and fast transactions, making it highly energy-efficient.

The Technology Behind Eco-Friendly Blockchain Solutions

Here’s a breakdown of the tech powering eco-friendly blockchain solutions.

Key Technologies in Green Cryptocurrencies

To start with, let’s look at a few of the core technologies that drive energy efficiency in green cryptocurrencies:

Carbon Offsetting:

- Some projects are now implementing carbon offset programs as a way to make up for any environmental impact they might still have. In short, they calculate their emissions and fund projects like reforestation or renewable energy initiatives to “offset” their carbon output.

- A good example is Algorand, which actively offsets its carbon footprint, working with ClimateTrade to support green projects. They even aim to go carbon-negative, which means they’re working to reduce carbon from the atmosphere rather than just balancing out what they emit.

Energy-Efficient Consensus Mechanisms:

Beyond PoS, there are other consensus mechanisms designed specifically to consume less energy, like Proof of Authority (PoA) or Proof of Burn (PoB).

These systems are built to be efficient without compromising the security or reliability of the blockchain.

The Role of Renewable Energy

Let’s talk about the power source itself. Some eco-friendly blockchain projects are committed to using renewable energy for their operations. Here’s how this plays out:

- Wind, Solar, and Hydro: These projects often partner with renewable energy providers or set up operations in regions with access to green energy sources like wind farms, solar panels, or hydroelectric plants.

- Localized Green Mining: For projects that still use some form of mining, many are starting to adopt what’s called localized green mining, where mining rigs are set up in areas with excess renewable energy. This way, they’re not only reducing their carbon footprint but also utilizing clean, otherwise wasted energy.

For example, a project might establish its operations in regions with surplus hydropower to keep mining and validation operations running. It’s a win-win: lower costs, and less environmental impact.

More Innovations in Blockchain Sustainability

On top of these mechanisms, there are newer technologies that make blockchain itself more efficient and scalable, even without changing the underlying consensus mechanism.

Here’s a look at a few of the standout innovations:

Layer 2 Solutions:

- Layer 2 solutions are designed to reduce the load on the main blockchain by handling a portion of transactions “off-chain” before verifying them on the main blockchain.

- This system decreases the need for each transaction to pass through the main blockchain, cutting down on both costs and energy use.

- Projects like Ethereum, with its Ethereum 2.0 upgrade, incorporate these solutions to facilitate processing and reduce energy consumption.

Sharding:

- Sharding is like splitting up a database into smaller, more manageable pieces, called “shards.” Instead of having every node in the blockchain network validate each transaction, sharding allows different nodes to validate only a portion of the data.

- This approach massively reduces the computational power required for the network to function, while also enabling faster transaction speeds.

- It’s a technique that Ethereum, for example, is working to incorporate, and it’s expected to play a big role in making blockchain networks more sustainable and scalable.

Blockchain as a Service (BaaS):

- Some eco-friendly platforms are starting to offer Blockchain as a Service to businesses. This way, companies can utilize blockchain for secure transactions without needing to run their own energy-draining infrastructure.

- By centralizing resources, BaaS providers can optimize energy use while still providing blockchain’s benefits. This is a growing trend that will likely make blockchain more accessible without the energy overhead.

Challenges Faced by Green Cryptocurrencies

While green cryptocurrencies sound great on paper, making them a reality isn’t as easy as flipping a switch.

From tech limitations to market acceptance, these eco-friendly solutions have some real hurdles to clear before they become the go-to choice for investors and users alike.

Limited Adoption and Awareness

One of the biggest challenges for green cryptocurrencies is that, well, most people just aren’t aware of them.

Traditional cryptocurrencies like Bitcoin and Ethereum have dominated the market for years, and they’re household names at this point. In contrast, eco-friendly alternatives like Algorand, Tezos, and Cardano are still flying under the radar for a lot of casual users and even some investors.

- Public Awareness: People outside the crypto community often have no idea that green options exist. Even those who are aware may not fully understand the environmental differences between, say, Bitcoin and a Proof-of-Stake coin like Cardano.

- Perception Issue: Since traditional cryptocurrencies were the first to break into the mainstream, many people associate crypto with high energy use by default. Changing this perception is no small task, especially when the media tends to focus on the environmental issues associated with Bitcoin mining.

To overcome this, green cryptocurrencies need more visibility and educational efforts. It’s not enough to just be eco-friendly—they need to get that message out to the public effectively.

Technological Hurdles

Green cryptocurrencies are often built on new and sometimes experimental technologies, which means they face some serious technical challenges along the way.

Scaling and Performance:

- While Proof of Stake and other green mechanisms are great for energy savings, they still have scaling issues. PoS systems, for instance, can struggle with transaction throughput as demand increases.

Ethereum, despite moving to PoS, is still working on layer-2 solutions like rollups to handle more transactions without sacrificing performance.

- Sharding and layer-2 solutions (like rollups) help but aren’t fully matured across all green blockchains. So, while they’re more energy-efficient, they still face speed bumps when it comes to processing large numbers of transactions efficiently.

Security Concerns:

- New technologies always come with security risks. Because green cryptocurrencies often implement unique protocols or modifications to standard blockchain structures, they sometimes face criticism for being more susceptible to attacks.

- Proof of Stake, for instance, has different security vulnerabilities compared to Proof of Work, and some critics argue that it’s less battle-tested.

Market Competition with Traditional Cryptocurrencies

Green cryptocurrencies are also up against some serious market competition. Bitcoin, Ethereum (even post-PoS), and other established cryptocurrencies have massive user bases, investor trust, and years of network effect.

- Entrenched Market Leaders: Bitcoin is still viewed as the “gold standard” of crypto, with Ethereum close behind as the powerhouse for decentralized applications. This level of familiarity and trust makes it tough for green cryptos to break in, even if they’re objectively better for the environment.

- Loyalty to PoW: Some people in the crypto community are big proponents of Proof of Work (PoW) because it’s known for being highly secure and decentralized. These traditionalists often see PoW as the best choice for preserving blockchain’s core values, despite its environmental impact, and may be reluctant to embrace newer methods.

- Investment Dynamics: Investors often follow where the money is, and the biggest investments still go into Bitcoin and Ethereum. Until green cryptocurrencies can prove themselves as equally profitable or even more so, they’ll continue to play catch-up in the broader market.

Ongoing Debate About Eco-Friendly Solutions

Even among supporters of green crypto, there’s an ongoing debate about what actually makes a cryptocurrency “green.”

- Effectiveness of Proof of Stake: Some argue that while Proof of Stake is more energy-efficient than Proof of Work, it isn’t a perfect solution. Critics point out that PoS can lead to centralization because wealthier participants can stake more, thus controlling more of the network.

This goes against the decentralized ethos of crypto and raises questions about how “green” centralization really is.

- Carbon Offsetting Skepticism: Carbon offsetting is another tactic used by some green cryptocurrencies, but it’s a controversial topic.

Some say that offsetting is more of a “band-aid” solution rather than addressing the root cause of carbon emissions. It’s a quick fix, but it doesn’t necessarily solve the underlying environmental impact.

- The “Greenwashing” Problem: As more cryptocurrencies advertise themselves as eco-friendly, there’s a risk of greenwashing—where projects market themselves as sustainable without truly adopting meaningful environmental practices.

This leads to skepticism among investors and consumers, who may find it hard to separate genuinely green projects from those that are simply capitalizing on the trend.

The Future Outlook for Green Cryptocurrencies

As awareness grows and technologies mature, it’s clear that these green solutions have a real shot at transforming the crypto space.

There are big opportunities lining up — potential partnerships, tech improvements, and a push from the community to make crypto not just a disruptive financial tool but also a sustainable one.

Emerging Technologies & Developments

The evolution of blockchain technology is accelerating, and green cryptocurrencies stand to benefit in some exciting ways. We’re likely to see more advancements designed to make crypto both faster and greener.

- Next-Gen Consensus Mechanisms: Beyond PoS, there are other consensus mechanisms emerging that aim to improve efficiency and reduce energy consumption even further.

For example, Proof of Space, which uses hard drive storage rather than intensive computational power, or Proof of Authority, which could reduce the environmental toll while maintaining a high level of security.

- Layer 2 Solutions and Sharding: Ethereum’s move to PoS was a big step, but its real push toward efficiency might come from Layer 2 solutions (like rollups) and sharding, which break down transaction loads into smaller, manageable pieces.

These innovations mean more transactions with less energy use—a big win for sustainability.

- AI and Machine Learning Integration: While still experimental, there’s talk of using AI and machine learning to optimize blockchain networks. These technologies could dynamically adjust energy usage based on network demand, helping green cryptos further cut down on their carbon footprint.

The Role of Community Involvement and Education

Community involvement is going to be a huge factor in driving the future of green crypto. The more people understand the impact of their investments and transaction choices, the more they can support eco-friendly options.

- Educational Campaigns: Educating users on the differences between traditional and green cryptocurrencies is essential. Many people still don’t realize how big a difference PoS makes compared to PoW.

Projects could launch educational campaigns, create simple guides, and even host online events to spread the word about green options.

- Transparency and Reporting: The crypto community values transparency, so green cryptocurrencies that publish regular sustainability reports will likely stand out.

By being upfront about their energy consumption, carbon offsets, and partnerships, these projects can build a loyal community that actively supports their mission.

Conclusion

As we look to the future of cryptocurrencies, eco-friendly digital currencies are proving that sustainability can coexist with innovation. Green cryptos are tackling annual energy consumption and reducing reliance on fossil fuels by using technologies like Proof of Stake, carbon offset programs, and renewable energy. These methods result in significantly less energy usage compared to traditional mining, while also leveraging computing power more efficiently.

Despite challenges like scaling and competition with cryptos like Bitcoin, green cryptocurrencies are poised to lead the way toward a more sustainable financial system. With growing awareness and emerging technologies, the future of green crypto, including carbon credits and digital currency solutions, looks promising.

Level Up Your Business with Eco-Friendly Blockchain Solutions

Looking to get ahead in the world of green cryptocurrencies? At WowLabz, we’re all about building smart, sustainable blockchain solutions that not only power your business but also help the planet.

Our blockchain development services focus on energy-efficient technologies that make a real impact. Get in touch with us today and see how we can help you make the future of finance greener and more innovative.